All About Credit Scores

Category: Credit

By: Sente Mortgage

What is a credit score?

A credit score is a numerical expression based on a level analysis of a person's credit files, to represent the creditworthiness of the person. In other words, it is a way of predicting the likelihood of a borrower’s ability to repay. The higher the credit score the higher probability of repayment. Lenders use credit scores to determine who qualifies for a loan, at what interest rate, and what credit limits.

Today, credit scores are numbers developed by the Fair Isaac corporation and are called FICO® scores. They vary between 300 and 850 and are calculated based on algorithms established by FICO. The purpose of a credit score is to examine patterns of credit history in order to rank someone based on their future credit risk. FICO scores are determined at each of the three credit bureaus: Equifax, Experian and TransUnion. All three credit bureaus use the same algorithm established by FICO, but the scores are rarely the same. Why? Because merchants report their customers’ payment activities at different times. Also, some merchants don’t subscribe to all three bureaus and might only one when evaluating a credit request.

Why is a credit score important?

Your credit score defines your ability to get credit and how much you have to pay for that credit. For example:

- Home loans usually require a minimum credit score of 620 to be considered for a mortgage. The higher the score, the lower the interest rate you will pay.

- If you want to rent an apartment, your landlord will look at your credit score. If your credit score is low, they may decide not to rent to you. If they do rent to you, your deposit for the apartment, as well as your utilities, may be higher than someone with a good credit score.

- When you apply for a credit card, your credit score will be one of several factors considered in whether to grant credit. Each company has it’s own rules about the role of credit scores, but nearly every company considers them. In addition, most credit card companies review your score periodically and may adjust your rate upward if your credit score goes down.

- If you want to purchase or lease a car, then credit scores play a couple of roles. Most companies require a minimum score to extend credit. Beyond that, the lower the score, the higher the interest rate.

Your credit score changes based on how much debt you have and how well you manage that debt.

Where do credit scores come from and how are they calculated?

There are 3 agencies that calculate, and report your credit scores. They are Equifax, Experian and TransUnion. Each of them has their own calculation, so the score reported may be different depending on which agency is reporting. Most lenders get reports and scores from all 3 and use the middle score to evaluate your ability to repay.

There are various factors that are used in calculating your credit score. There are also specific details that are not part of the calculation. Let’s explore how your credit score is calculated.

First, let’s start with items that are not considered in your credit score. These include:

- Your race, color, religion, national origin, sex and marital status.

- Your age.

- Your salary, occupation, title, employer, date employed or employment history.

- Where you live.

- Any interest rate being charged on a particular credit card or other account.

- Any items reported as child/family support obligations or rental agreements.

- Any information not found in your credit report.

- Any information that is not proven to be predictive of future credit performance.

- Whether or not you are participating in a credit counseling of any kind.

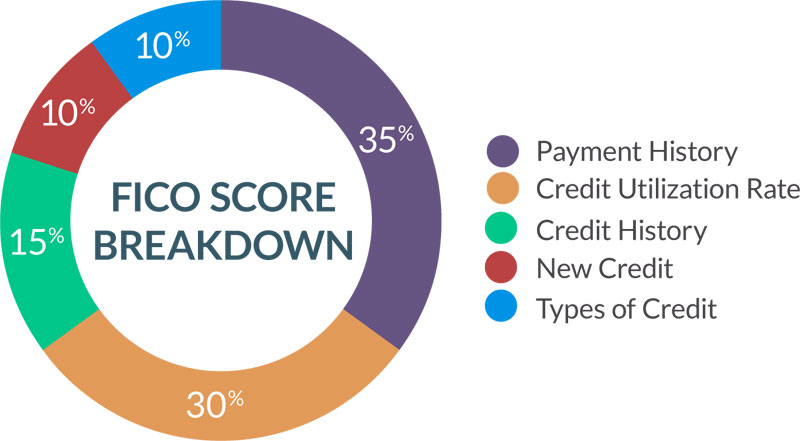

Next, there are 5 parts to the calculation of your credit score and each are weighted differently:

- Payment History makes up 35% of the calculation.

- Amounts Owed accounts for 30% of the calculation.

- Length of Credit History is 15% of the calculation.

- Types of Credit account for 10% of the calculation.

- New Credit makes up the final 10% of the calculation.

Payment History Calculation

Payment history is one of the largest percentages considered in your credit score. Let’s take a minute and examine what is included in this portion of the credit score. Following are items that are included in the payment history calculation:

- Payment information on specific types of accounts (credit cards, loans, mortgage, etc.). Payment information includes if you paid on time, if you paid the appropriate amount and if there were any “late pays.” Remember, late payments have a negative impact on your credit score. While the larger the number of accounts paid on time positively impacts on your score.

- Public Records. The presence of adverse public records such as bankruptcy, wage attachments, or items that have been posted for collection will negatively impact your score. Past due items can also negatively impact your score. For example, the length of time a debt is past due, the amount past due, the total number of past due items, and recent items past due have a bigger negative impact on your credit score.

Ready to find our how much house you can afford?

Plug in some numbers and explore your borrowing power. Estimate how much house you can afford, monthly payments, evaluate interest rates, and compare loans against each other with this simple tool.

Amount Owed Calculation

The amount owed calculation is a summary of all amounts owed and how much available credit has not been used. Following are items that are included in the amount owed calculation:

- The amount owed on all accounts and on specific accounts will impact your score. For example, large credit card balances will have a greater negative impact than a large mortgage.

- The number of accounts that have an outstanding balance will have a negative impact, or lower, your score. The amount of “available credit” or credit lines that you have not used will have a positive impact on and will help raise your score.

Length of credit history

The length of credit history calculation is an analysis of how long you have had credit overall and with specific accounts. Following are items that are included in the length of credit calculation:

- The length of time you have had each account can have a positive impact on your score. Longer term accounts can help increase your score.

- The length of time an account has not been used or how long an account has gone unused may have a negative impact.

New credit

The new credit calculation is a summary of all newly opened or recent accounts. Following are items that are included in the new credit calculation:

- The number of recently opened accounts can have a negative impact.

- The number of recent credit inquiries won’t impact the score, but opening several accounts will.

Types of credit used

The types of credit used can impact your credit score. For example, the use of varied accounts such as credit cards,credit cards, retail accounts, installment loans, mortgage, consumer finance accounts can have a positive impact on your credit score.

What is a credit report and why is it important?

The credit report is an analysis of your credit history and outlines accounts, amounts, late payments and delinquencies. The credit score comes from the information on the credit report.

The information on the credit report comes from your social security number, date of birth and employment information that you provide to lenders or companies when you apply for credit. The credit reporting agencies update this information regularly based on data supplied by credit vendors.

Once credit has been established, lenders report the status of that credit to the credit reporting agencies creating a credit report. The agencies track and report:

- Trade lines. Trade lines are basically your credit accounts and lenders report on each account you have established with them. They report the type of account (bankcard, auto loan, mortgage, etc), the date you opened the account, your credit limit or loan amount, the account balance and your payment history.

- Credit inquiries. When you apply for a loan, you authorize your lender to ask for a copy of your credit report. This is how inquiries appear on your credit report. The inquiries section contains a list of everyone who accessed your credit report within the last two years.

- Public record and collection items. Credit reporting agencies also collect public record information from state and county courts, and information on overdue debt from collection agencies. Public record information includes bankruptcies, foreclosures, suits, wage attachments, liens and judgments.

How do I know what is on my credit report?

You are entitled to one free credit report a year from each of the 3 reporting agencies. The simplest way to get this report is through the web site: www.AnnualCreditReport.com

You can also get the report by calling, toll-free, 1-877-322-8228. Note that this is a credit report and does not include your credit score.

You are also entitled to a copy of your credit report if you are ever denied credit. If you are denied credit, you will be informed of the reason and given information to track down the cause.

What happens if the information is incorrect?

To ensure that any mistakes get corrected as quickly as possible, contact both the credit bureau and organization that provided the information to the bureau. Here is how to do this:

- Write to the credit bureau and provide them with the information that you believe is inaccurate. Clearly identify each item in your report that is in dispute. State the facts and explain why you dispute the information. Request deletion or correction of the item.

- Write to the appropriate creditor, or other information provider, and explain that you are disputing the information provided to the bureau.

Expect this process to take between 30 and 90 days. Below is the contact information for the different reporting agencies:

- Equifax

www.equifax.com

P: 1-800-685-1111 - Experian

www.experian.com

P: 1-866-200-6020 - TransUnion

www.transunion.com

P: 1-800-888-4213

How can I improve my credit score?

Borrowing money requires good credit as it protects the lender by reducing the risk of default. A good credit score, and credit report, are important to you because the higher the credit score, the lower the interest rate you will pay. The good news is that everyone can improve their credit score. Here are few simple steps to get started:

- Pay bills on time. Paying on time has the single biggest impact on your credit score.

- Reduce your credit card balances. Reducing your credit card balances means not only regular payment and not accumulating more credit card debt, it also includes paying off debt rather than moving it between credit cards. Moving between cards can have a double negative impact as it keeps your debt level high and shows a more new credit. Apply for new accounts only when you need them. Many stores offer a discount if your apply for, and use their card, but accumulating new credit can be a drain on your score. Only apply if there is a significant advantage (a large purchase—a new refrigerator, for example).

- Get your credit report and check it for errors. Staying on top of your credit score, and report, is good practice and can be particularly important if you have had errors in the past or if you have a common name. There are a lot of “Bob Smiths” out there, and they may not all have stellar credit.

What can I do if I have bad credit?

If you have bad credit, you can change your credit situation but you might need help to guide you through the process. It is important to conduct your due diligence in terms of who you use to help you with credit repair. According to the Federal Trade Commission they advise the following:

Everyday, companies target consumers who have poor credit histories with promises to clean up their credit report so they can get a car loan, a home mortgage, insurance, or even a job once they pay them a fee for the service. The truth is, these companies can’t deliver an improved credit report for you using the tactics they promote. It’s illegal: No one can remove accurate negative information from your credit report. So after you pay them hundreds or thousands of dollars in fees, you’re left with the same credit report and someone else has your money.

If you see a credit repair offer, here’s how to tell if the company behind it is reputable and can truly help you fix your credit:

- The company wants you to pay for credit repair services before they provide any services. Under the Credit Repair Organizations Act, credit repair companies cannot require you to pay until they have completed the services they have promised.

- The company advises you of your rights and what you can do for yourself for free.

- The company recommends that you do not contact any of the three major national credit reporting companies directly.

- The company tells you they can get rid of most or all the negative credit information in your credit report - even if that information is accurate and current.

- The company suggests that you try to invent a “new” credit identity — and then, a new credit report — by applying for an Employer Identification Number to use instead of your Social Security number.

- The company advises you to dispute all the information in your credit report, regardless of its accuracy or timeliness.

The best way to find help is to ask around -- any mortgage or real estate expert should be able to give you a list of referrals that specialize in credit repair services.

Conclusion

Your credit score is a key component in the ability to borrow money and should not be taken for granted. Regardless of whether you are looking to purchase a home now, or in the future, monitoring and understanding your credit is a prudent financial practice. If you have good credit, continuing to pay on time and use credit wisely will keep you in good standing. If you have work to be done, don’t stress, with a little work and some with credit repair you are on your way to changing your credit score and ultimately your financial situation.

You may also like:

Sente Mortgage has received hundreds of five-star reviews for it's exemplary service and support.

Featured Posts

Silicon Valley Bank’s collapse has caused turmoil in the markets and various speculation — but one obvious outcome is how this event has affected…

Read MoreThe Federal Reserve just raised the federal funds rate in an attempt to battle inflation — but the Fed’s rates and mortgage interest rates…

Read MoreContact Sente

We'd love to hear from you. Just give us some basic info and someone will get back to you shortly.