How the Silicon Valley Bank Collapse Impacted Rates This Week

Silicon Valley Bank’s collapse has caused turmoil in the markets and various speculation — but one obvious outcome is how this event has affected mortgage interest rates.

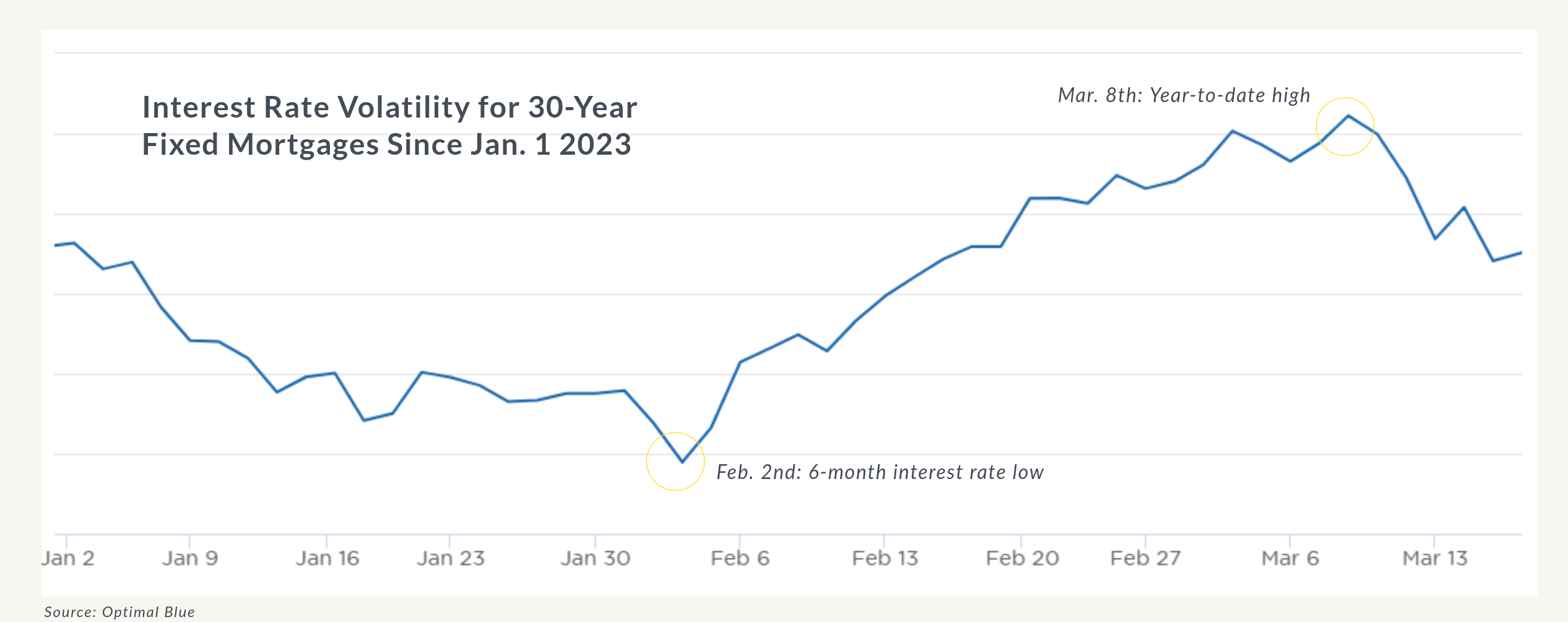

Rates hit a 6-month low on Feb. 2nd, then shot up to a high by the beginning of March. As soon as SVB’s failure was announced, mortgage interest rates shifted and started dropping. Why? Because in tumultuous or uncertain times, people chase security. From an investment standpoint, that means turning to gold, bonds…and mortgage-backed securities, which positively affects mortgage interest rates.

While this is an evolving situation, I wanted to keep you informed of market movements and what this mean for your clients. When rate changes are erratic and unpredictable — such as a sudden bank failure that swiftly changes the course of interest rates — there may be short windows of opportunity for your clients to take advantage, and they should be ready to move fast.

Chart Source: Optimal Blue