The New Year’s Resolution You Shouldn’t Overlook: Checking Your Net Worth

As we bid farewell to the old and welcome the new, many of us embark on the journey of setting resolutions for the coming year. While popular resolutions often revolve around health, fitness, and personal development, there’s one crucial aspect of our lives that deserves a spot on the resolution list: our financial well-being. Checking in on your net worth, particularly at the beginning of a new year, is a habit that can significantly impact your financial health and set the stage for a prosperous future. Click here to download our easy-to-use Net Worth Worksheet.

Understanding Net Worth:

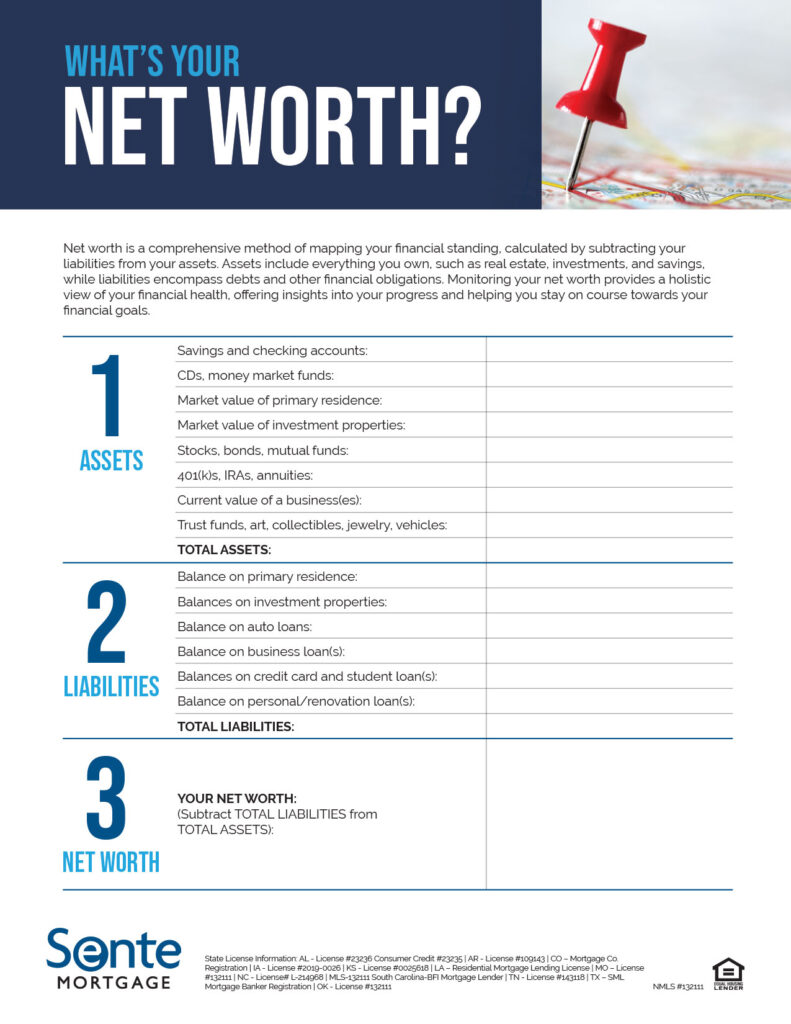

Net worth is a comprehensive measure of your financial standing, calculated by subtracting your liabilities from your assets. Assets include everything you own, such as real estate, investments, and savings, while liabilities encompass debts and other financial obligations. Monitoring your net worth provides a holistic view of your financial health, offering insights into your progress towards financial goals and helping you make informed decisions.

A Couple of Things to Remember:

- If the value of your home has increased, so have your assets. For a current housing valuation, visit with your real estate agent. Also, realize that while the increase is good for your net worth, it may impact your property taxes down the road.

- Take note of your investment strategy. If your portfolio has increased, your asset allocation may be out of balance. You may want to consider having a talk with your financial planner to help you determine your ideal combination of medium, high, and low-risk assets.

Asset Categories to Include:

- Cash and liquid assets, including current checking and saving account balances, CDs, and Money Market accounts.

- Investments, including Treasury bills, bonds, mutual funds, stocks and options, as well as retirement savings in a 401(k), IRA, or pension.

- Real estate, inclusive of the market value of your primary residence as well as vacation and investment properties.

- Miscellaneous assets, such as the value of private businesses, life insurance, trust funds, vehicles, art, collectibles, and jewelry.

Liability Categories to Include:

- Mortgage balances, including any balances on primary, vacation, or investment properties.

- Secured loans, such as balances on autos, recreational vehicles, and business loans.

- Unsecured loans, including all credit card and student loan balances, personal and renovation loans, cash advances, and medical bills.

- Taxes, inclusive of property and annual income taxes due.

As you embark on your journey into the new year, make it a priority to check in on your net worth. This simple yet powerful practice provides a roadmap for your financial future, helping you make informed decisions, track your progress, and stay on course towards your financial goals. By cultivating financial awareness and regularly assessing your net worth, you’re not only setting yourself up for success but also ensuring that your financial well-being remains a key focus throughout the year and beyond.