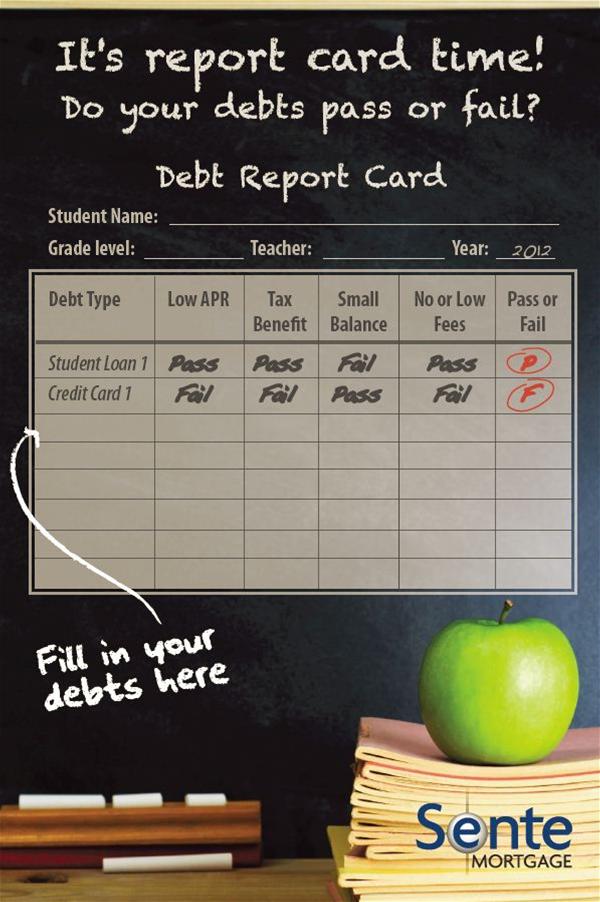

Debt Report Card

When evaluating debt reduction strategies first evaluate all of your debts. Then, grade them based on criteria that can help you decide which debt is “good” versus “bad.” Finally prioritize your payoff plans accordingly.

It’s important to remember that it’s not just the size of the debt or the annual percentage rate that matter. Sometimes we uncover fees in addition to interest that increase the cost of the borrowed money.

For example, student loans have become a larger part of some families’ debt load. In fact, in 2011 the total U.S. student loan debt surpassed the total credit card debt for the first time. Student loans have traditionally been graded as “good debt,” so long as they have fixed, favorable interest rates and tax-deductible interest. If choices need to be made, these loans can wait for payment until you’ve retired debts with higher interest and fees.

But some student loans may qualify as “bad debt.” Consider paying off those ASAP if you have a variable loan with a private lender, for example, and the current rate is far too high for comfort. Or if your interest is no longer tax-deductible because you’ve changed tax brackets since you secured the loan and your payments no longer qualify.

So grade your debts, and pay off the worst first. Just be sure you are taking the true cost of the funds into account!