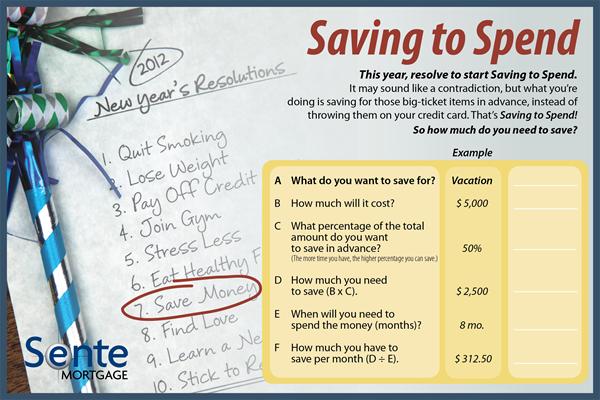

Saving To Spend

Did you make a New Year’s resolution in 2012? It’s not too late – consider resolving to be more diligent about Saving to Spend.

What does that mean? Unlike emergency or retirement savings, Saving to Spend is for major purchases in the foreseeable future. These are typically high-cost items that you can plan on such as a home remodel, special vacation or child’s wedding. Or, you can just as easily use this for wish-list items like a flat-screen TV, new computer, or a special gift.

Saving to Spend helps prevent these expenses from costing you more than necessary. If you save up for a $5,000 purchase, there is no additional cost. If you finance that same purchase for a year at 12% interest, you spend an extra $300. If you only make minimum payments, your cost can double!

Here’s the secret: create a separate Saving to Spend account. Next, use the chart on the image below to figure out how much you need to save. Then, stash your monthly savings amount in this special account.

You can encourage others in your household to help too! For example, if your 14-year-old wants a car when she turns 16, you can both save and watch the account grow even faster.

This year, resolve to try Saving to Spend. You’ll feel more in control of your spending, and really proud of your success.