Start 2021 Strong: The Net Worth Calculator

Hello, 2021! While there have been no shortage of major events recently, this is a natural time of year to reflect on the past 12 months, intentionally set new goals, and do a little “financial housecleaning” for a strong start.

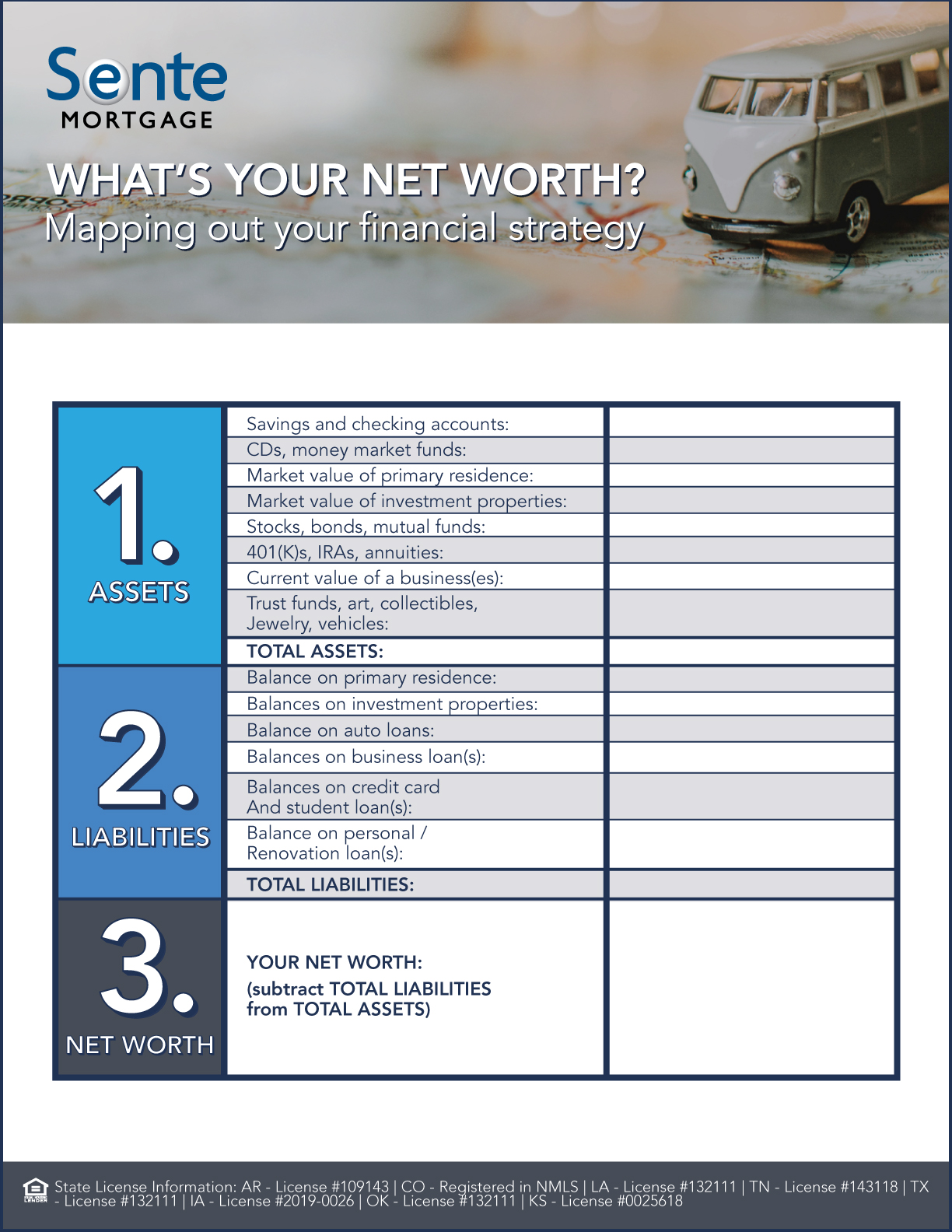

Something we recommend at the beginning of a fresh year is developing your personal financial road map — beginning with our Net Worth Calculator to get a solid understanding of your starting point. “Net worth” is simply the difference between what you own (assets) and what you owe (liabilities).

This is a powerful exercise that will help you assess your financial solvency and compare your net worth to your overall financial goals (or using net worth to help identify your goals). We highly encourage the practice of calculating your net worth on at least an annual basis, as you’ll then be able to chart your financial progress over time. Haven’t done this before? There’s no better time to get started. Is this already part of your routine? Excellent — consider this your reminder!

A couple of quick things to remember as you calculate your personal net worth:

- If the value of your home has increased, so have your assets. For a current housing valuation, visit with your real estate agent. Also, realize that while the increase is good for your net worth, it may impact your property taxes down the road.

- Take note of your investment strategy. If your portfolio has increased, your asset allocation may be out of balance. You may want to consider having a talk with your financial planner to help you determine your ideal combination of medium/high and low-risk assets.

Assets can be broken down into categories such as:

- Cash & Liquid Assets: Current checking and savings account balances, CDs, and Money Market accounts.

- Investments: Treasury bills, bonds, mutual funds, stocks and options, as well as retirement savings in 401k, IRAs, and pensions.

- Real Estate: Market value of your primary residence as well as vacation and investment properties.

- Other: Value of private businesses, life insurance, trust funds, vehicles, art, collectibles, and jewelry.

A good rule of thumb is to include anything equaling $500 or more in value.

Liabilities are also be broken out into categories like:

- Mortgages: Balances on primary, vacation, and investment properties.

- Secured Loans: Balances on auto, recreational vehicle, and business loans.

- Unsecured Loans: All credit card and student loan balances, personal and renovation loans, cash advances, and medical bills.

- Taxes: Property and annual income taxes due.

Knowledge is power. By using the below calculator to take inventory of your current financial situation now, you’ll be able to set even more realistic and attainable goals for 2021.