The 20 Percent Solution

“I wish I’d known that earlier!” How many times have you said that while looking at your finances? At Sente, we hear it so often that it really pushes us to keep sharing the sound practices we’ve learned.

Retirement seems far away to the young. But most likely, today’s youth will have to fund their retirement differently than the way their parents did, potentially without Social Security. Without that safety net, today’s kids may have only their investments to rely on for a comfortable retirement.

Time is the saving grace. The next generation has time to harness the full potential of compound interest. Motivating young people to save now is tough, but they need to know that at the end of their career small, consistent investment can yield a huge dividend.

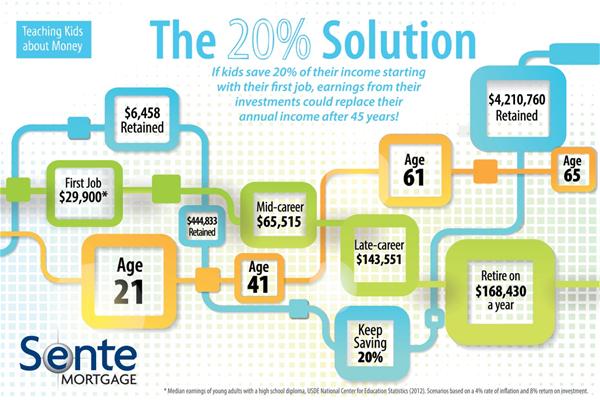

Let’s say a young person saves 20% every year, starting with her first job. Now let’s say she retires in 45 years. At that time, the interest she’d be earning each year on her total savings would be the same as her final working year’s pay — possibly even more (this assumes salary increases each year based on the inflation rate).

Just save 20%. It’s almost too easy. For adults with grown-up bills and obligations, 20% sounds nearly impossible. But imagine if kids start this with their first job, when all they have is discretionary income! It will be easier to turn saving first into a habit.

So whether you have kids of your own or know someone who does, share the 20% solution.