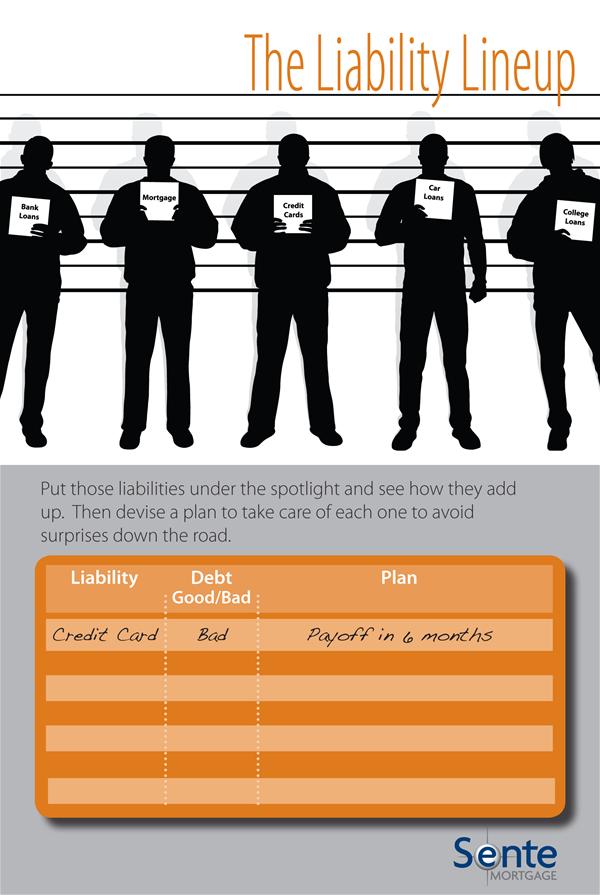

The Liability Line Up

In assessing your net worth, it's important to remember that your financial assets are offset by your liabilities. Once you have a clear picture of your liabilities and develop a plan to eliminate them, you can gain a lot of control over your financial future.

Here are some of the best practices we've learned to make it easier:

Line 'em up

- To determine whether a liability is "good debt" or "bad debt" ask this question: Does it facilitate growth in your wealth or does it drain your assets?

- Separate your good debt list from your bad debt list, then plan your attack on the bad guys first.

- Pay off Your Credit Cards.

- Conventional wisdom tells us to pay off the card with the highest balance or highest interest first. But you could also simply pay off the smaller-balance cards first, then move on to the next-lowest balance and so on. Knocking off entire cards is a satisfying reward and builds momentum in your efforts.

Perform a Mortgage Checkup

- It never hurts to give yourself a "mortgage checkup" just to see if you are managing this good debt effectively. Your Sente Mortgage Broker can help.

- Life circumstances may warrant paying more money each month or a different program may better fit your current situation.