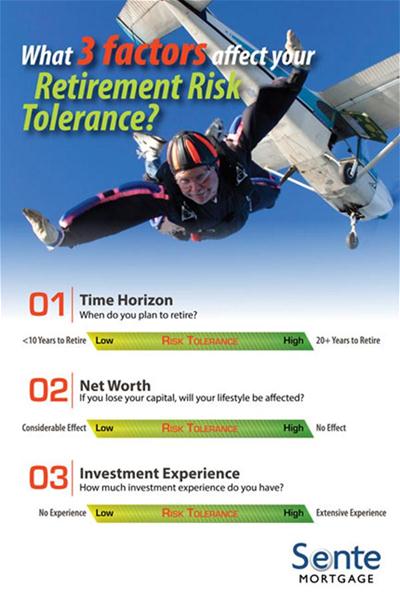

What 3 Factors Affect your Retirement Risk Tolerance?

When considering your retirement savings options, either individually or with your financial advisor, the seemingly simple question “What is my risk tolerance?” often comes up. We usually answer that question based on how we feel about taking risks in general. But for retirement investing, there are three specific factors we can use to find our answer.

Time Horizon

Usually, we look at this in terms of age—younger investors have more risk tolerance than older investors. However, it really isn’t about age as much as it is about how close you are to your desired retirement. A 40-year-old who wants to retire at 50 may have less risk tolerance than a 60-year-old who wants to retire at 80.

Net Worth

If your net worth is liquid enough to replace lost capital, then you can afford to take greater risks. However, if you can only replace lost earnings with money earmarked for current expenses, then your lifestyle will take a hit.

Investment Experience

If you have invested in many different opportunities over the years, you may have learned what works and what doesn’t. The seasoned investor may know how to take advantage of riskier opportunities, while a newer investor may want to look at more secure investments while learning the ropes.

Does looking at these three factors change how you define your retirement risk tolerance? Check in with your financial advisor to see if your investment choices are in alignment with your current risk tolerance.